Investment guide

Investing in diamonds

Are you about to make your first diamond investment? Don't worry - we are here to help. This investor guide has been specifically designed to help you to understand the diamond market, as well as advise you on how to make smart investment choices.

This guide takes 15 minutes to read and will help you to get started with your investments.

In this guide you will discover :

- Reasons to invest in diamonds

- Expert TIps when buying a diamond

- How to invest in diamonds, 7 tips to get you started

- A quick checklist when buying a diamond for investment purposes

- Other considerations to make when investing in diamonds.

- How you can invest in diamonds with Antwerpdiamonds.direct

- Selling your investment diamonds

- Diamond market information

Why invest in diamonds?

-

Their Beauty Won’t Fade

Diamonds are a valuable and strong raw material. As a result, they are not subject to the usual wear and tear of other antiques.

-

They Have Stood the Test of Time

Remarkably, diamonds have been traded since the 4th century. This longevity is a testament to their strength, rarity and beauty.

-

Their Value is Protected

The rising mining, manufacturing, shipping and insurance costs involved in bringing a diamond to market help to maintain their value.

-

They Are a Safe Investment

Diamonds, like other essential hard commodities such as gold and farmland, are considered to be protected from drops in inflation and decreases in the value of a currency.

-

They Are Something You Can Wear

There aren't many investments that you can take with you everywhere you go. Diamonds, thanks to their size, are an exception to the rule.

-

They Make an Excellent Gift

Diamonds can be gifted to your children or loved ones without the hassle of involving lawyers or notaries.

Diamonds have historically always been a wise investment choice. While there is always a small element of risk with any investment, diamonds have consistently increased in value by 3-5% per year over the last decade, irrespective of the world’s economy. It is this lack of volatility that makes diamonds such an attractive financial proposition many. Still, we do not advise on investing in diamonds for a quick return on your outlay. You need to allow time for your diamond investment to mature over a number of years if you are to take full advantage of its earning potential.

Expert Tip:

Choose a diamond that has a recognized worldwide Laboratory Report Certificate and that carries a laser engraving. This guarantees its authenticity and is crucial for ensuring its resale value. It is also best to also try and avoid any diamonds that have had their color or clarity enhanced, something of which you can be assured that we don’t stock at Antwerp Diamonds Direct.

How to invest in diamonds? 7 rules to get you started

Investing in diamonds means investing in physical commodities. This means you can easily buy them anywhere, even online. Investing in diamonds should be a part of your alternative investments and should occupy only a part of your total portfolio. The recommendations we have made below represent some basic guidelines on how to invest in diamonds.

- Learn the basics. Always start at the beginning, learn the diamonds language. Start with the 4 c's, learn about diamond certification.

- Set a budget. A golden rule, determine upfront what part of your investment portfolio should be physical commodities.

- Diversify your diamonds. Do not buy one diamond for your total budget. Try and buy several smaller diamonds so you can diversify your portfolio. This way you are ensured it will be easier to sell part of your investment later on

- Compare prices. Unlike stocks diamonds do not come with a fixed price. Depending on where you buy them you will be able to get a better price. Luckily as you can buy diamonds easily online it has become easier to find a diamond from a good source at a good price

- Buy rare, in-demand diamonds. Make sure that the diamonds you invest in are sought after on the market but also rare enough so they have a premium value

- Know what you buy. Perhaps the most important rule of all. Always buy certified and laser engraved diamonds from a respectable laboratory.

- Don't pay too much for your investment. Buying retail means that extra margins are being added on top of the value of the diamond. When we say don't pay too much we mean buy as high up the supply chain as you can. Try and buy directly from the diamond manufacturers (like us).

Finding the right diamond to invest in: our quick checklist

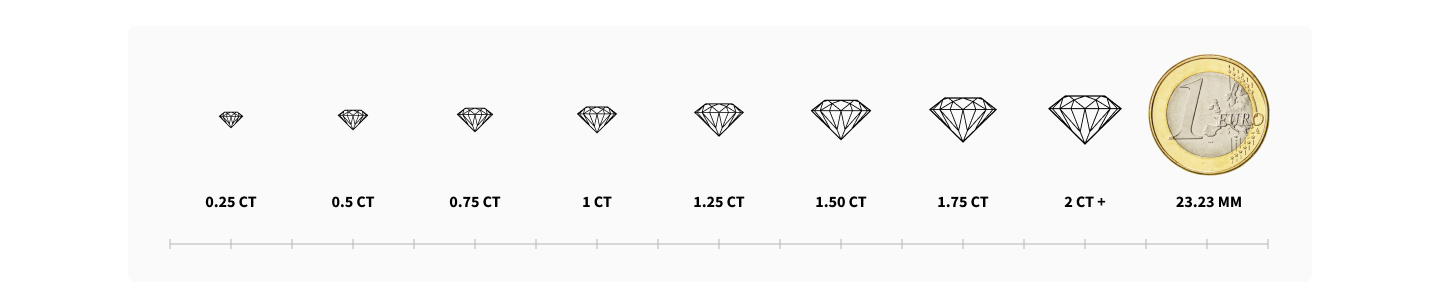

1. Select Weight or Carat

Diamonds that weigh between 0.50 carat and 1 carat are considered the wisest investment choices. This is partly down to the fact that they have shown to have a proven track record of maintaining their value, but also partly because their comparably lower cost to larger carat diamonds also allows you to buy more and then sell on parts of your investment as and when you want.

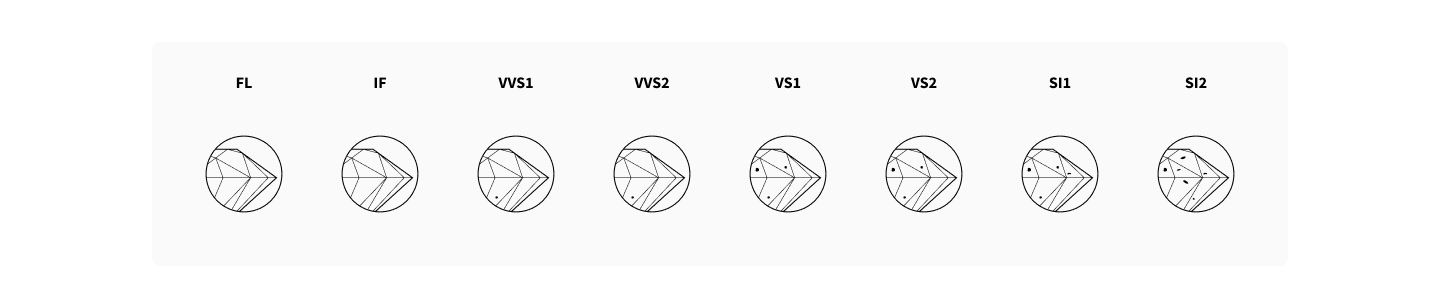

2. Select Clarity

If your budget allows, we recommend choosing a diamond with a clarity rating of IF (Loupe Clean) or FL. These are the rarest diamond group in the world and almost guarantee a healthy long-term investment profit.

A good alternative is to choose a diamond with a clarity rating of VVS 1. To an untrained eye, it is practically impossible to notice any difference between the three rating groups.

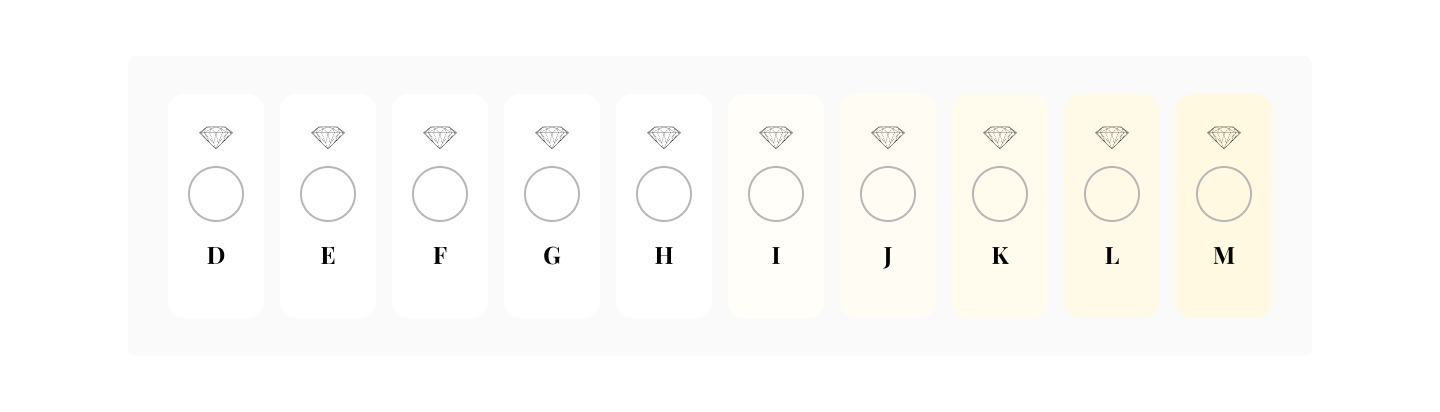

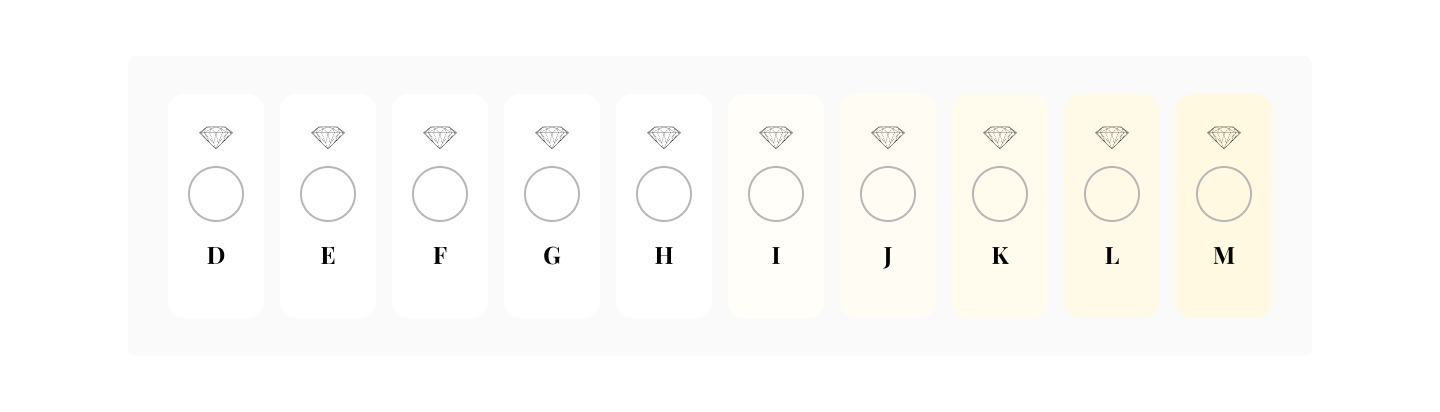

3. Select Colour

Always choose a colorless diamond if you are investing, as they rarely lose their appeal. They are measured in an alphabetical ranking system, with D representing the clearest blue white to Z representing a diamond with a light hue

4. Select certificate

When purchasing loose diamonds they should be certified by an accredited independent gemological laboratory. The most popular certifications are offered by:

- GIA — Gemological Institute of America

- IGI — International Gemological Institute

- HRD — Hoge Raad voor Diamant

5. Final step: select Shape

Round diamonds are the most commonly traded shape in the market, therefore making it easier for you to sell your diamond(s) on in the future.

Quick Reference guide

- Select a weight with a rounded number between 0.5 and 1 carat

- Select a diamond with a clarity IF of FL

- Make sure to select a colorless diamond ( preferably a D color)

- Only invest in certified diamonds by a world-leading Lab like IGI, GIA , HRD

- Round diamonds have the most liquidity and better value compared to other shapes

Investing in diamonds: other considerations

Diamonds are traded in US dollars. As a result, we would only recommend selling your diamond at a time when your ‘home’ currency is performing well against the dollar.

We truly believe that the range of diamonds we offer on our site are the best investment for your future thanks to their attractive price point and exceptional quality.

We offer three ways for you to invest in diamonds

Loose stones

If you consider yourself a new DIY investor, we would advise you not to extend yourself beyond your means. That is why we have selected a practical range of loose diamonds for you to invest in, from the affordable 0.5 carat stones to the more desirable 1.49 carat options.

In order to help with your search, we have incorporated a range of sliding options, which include cut, price, color and clarity of the diamond.

Once you complete the checkout process, your certified, laser inscribed diamond will be in your hands in just a matter of days, with the stone’s value increasing from the moment you make it your own.

Investment packages

If you are still feeling a bit unsure about which diamond to choose, then our premade investment packages could be perfect for you.

We have taken the time to create a range of sensible packages to suit every investor’s needs and budget.

If you cannot find a package that is absolutely perfect for you, then just let us know. We will listen to your requirements and then create the ultimate tailored money-making kit. The only condition is that your budget is 10 thousand Euros or above.

Premium stones

If you want to keep your risk down to a bare minimum, then choosing one of our premium round-shaped diamonds is the most sensible option. These glistening gems represent the top 1% of the diamonds in our range and only include internally flawless or loupe clean stones.

We will help you sell your diamond

If you are ready to cash in on your investment, then Antwerp Diamonds Direct should be your first port of call.

Thanks to our network of customers, wholesalers and other traders, we can provide all of our customers with the best possible platform for selling their diamond(s) at the best possible price.

We will also be on hand 24/7 to answer any of your queries and to keep you updated on the progress of the sale.

All of this can be obtained for just a 3% brokerage fee – a small price to pay when it could add on thousands to your sale.